The Path Forward

STARTUP EXPENSES

If you’ve started—or are planning to start—a business in the last three years, don’t

overlook your pre-opening

expenses. The IRS allows many of these costs to be deducted or amortized,

giving you valuable financial flexibility.

Startup costs include things like:

- Travel, dining, and meetings while planning your business

- Legal, licensing, and compliance fees

- Office equipment and tech setup

- Marketing, branding, and onboarding

- Infrastructure and research costs

Up to $5,000 of eligible startup expenses may be immediately deductible in your first year (with some limits).

This pre-operational phase is your chance to plan, test, and build your foundation—so your business can launch fully prepared and ready for success.

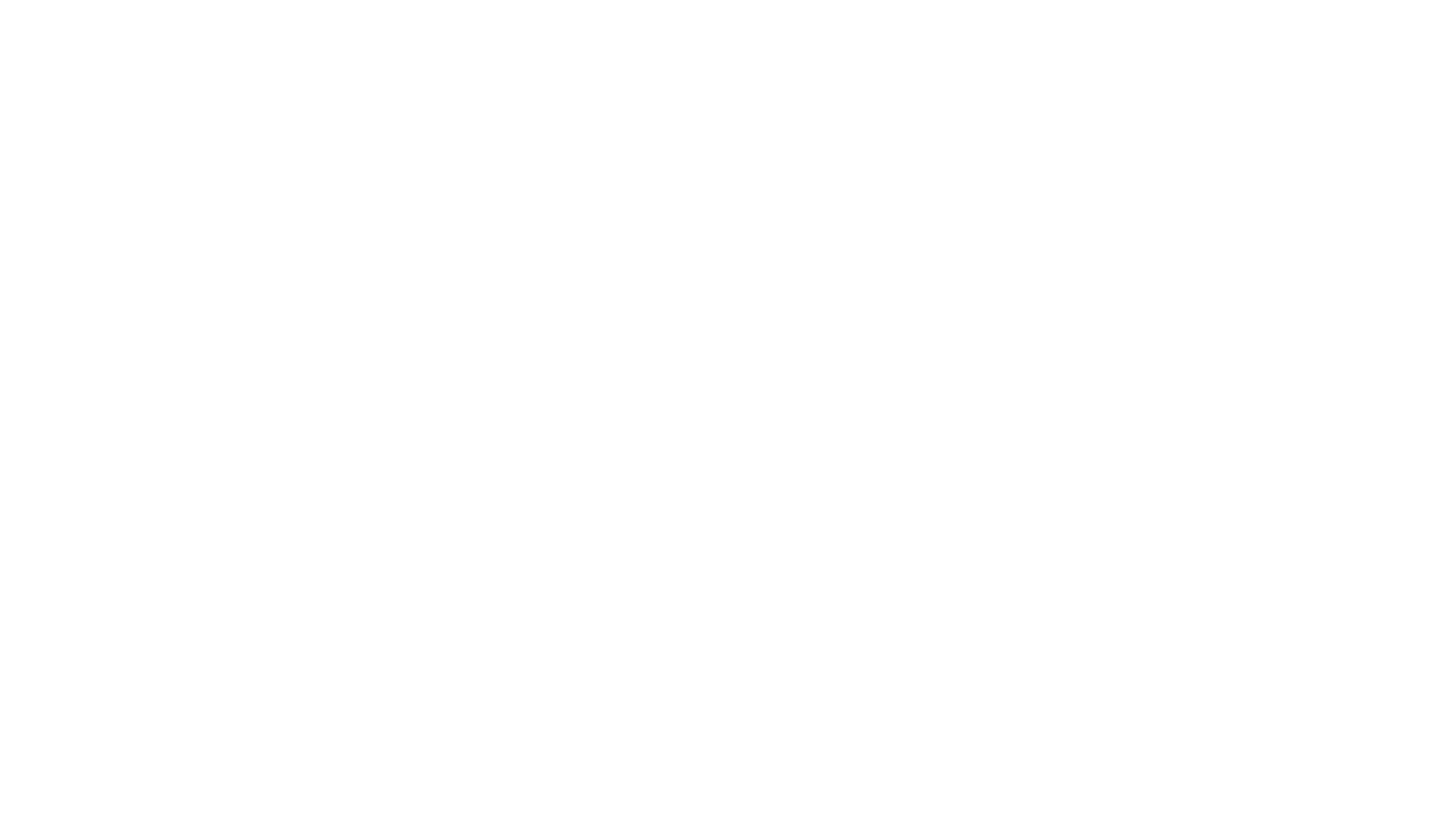

SINGLE ENTITY

You are paid on the 10th of the month based on any account that has your

rep code attached to it.

You need to set up a new personal bank account because you are paid via

your social security number.

Once the funds are received in your personal account you will

transfer/sweep 100% into your Entity account.

At the end of the year, you will receive 1099 from your Broker Dealer

for the amount deposited into your personal account. You will then

create a 1099 from you to your Entity for the same dollar amount this is

called nominee

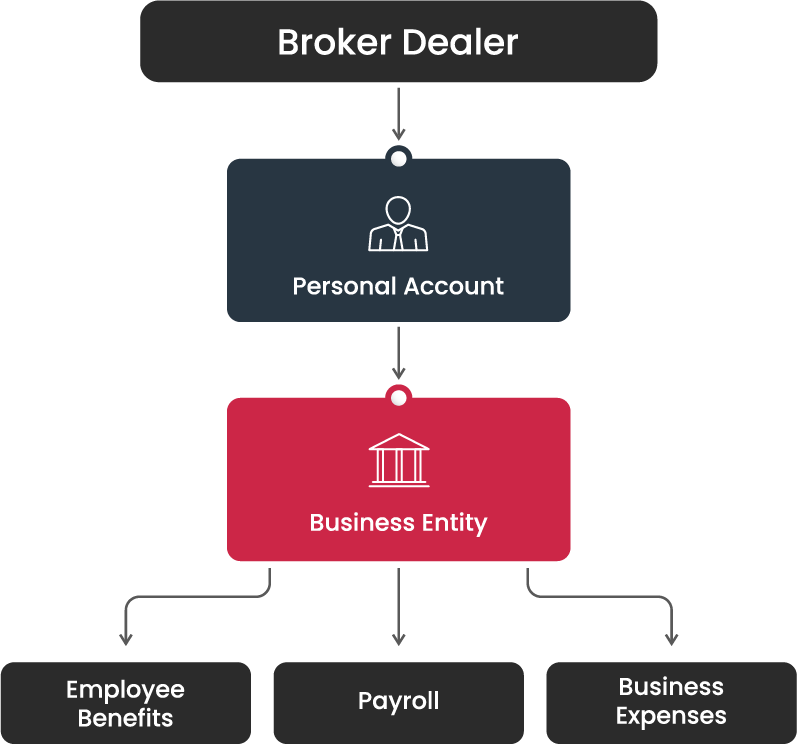

SINGLE ENTITY - 2FA

Each Advisor is paid on the 10th of the month based on any account that

has your rep code attached to it.

Each FA needs to set up a new personal bank account because they are

paid via your social security number.

Once the funds are received in your personal account they will

transfer/sweep 100% into the Entity account.

All business expenses will be paid at the entity level, including

Salary, distribution, and other expenses. You will need a comprehensive

operating agreement to outline expenses, contract, and distribution

level approvals.

At the end of the year, each FA will receive 1099 from your Broker

Dealer for the amount deposited into your personal account. Each FA will

then create a 1099 from themselves to the Entity for the same dollar

amount this is called nominee. All money left in the entity will flow

back proportionally to the FA’S personal tax return via a schedule C or

K-1 depending on the type of entity.

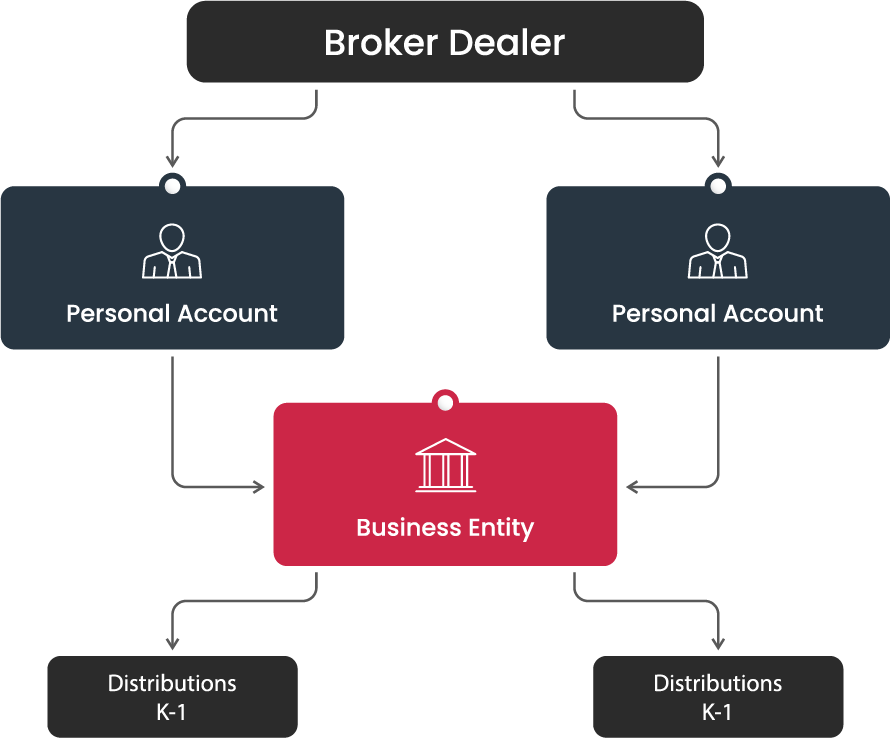

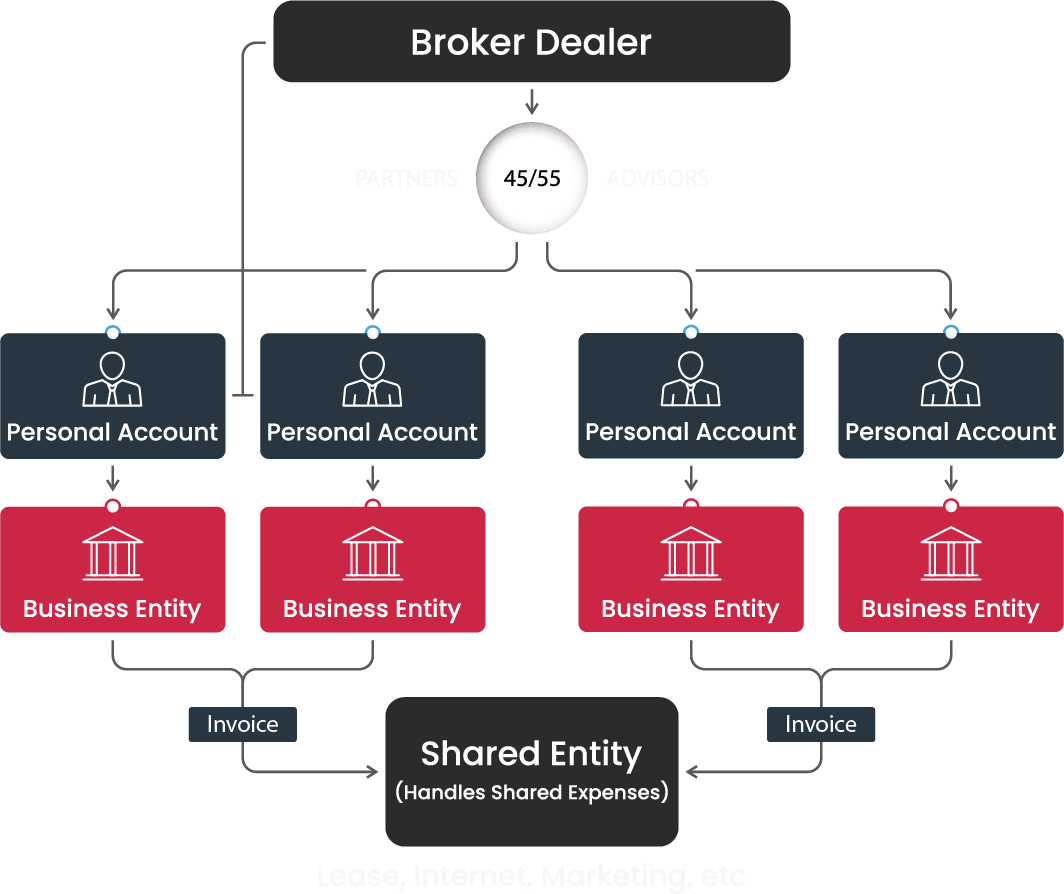

TWO OWNER ENTITY

Each Advisor is paid on the 10th of the month based on any account that

has your rep code attached to it.

Each FA needs to set up a new personal bank account because they are

paid via your social security number.

Each FA will set up their own individual Entity.

All FA involved in the Practice will set up a joint shared/Marketing

Entity.

Once the funds are received in your personal account, they will transfer

100% into their individual Entity account.

All Bills -Contracts will (example lease and Internet) be set up under

the joint entity.

Each FA will be responsible for their proposition share for the invoice.

The joint entity will invoice each FA for their share of the bill and

then the joint entity will pay the invoices.

All business expenses will be paid at the entity level, including

Salary, distribution, and other expenses. You will need a comprehensive

operating agreement to outline expenses, contract, and distribution

level approvals.

At the end of the year, each FA will receive 1099 from your Broker

Dealer for the amount deposited into your personal account. Each FA will

then create a 1099 from themselves to the Entity for the same dollar

amount this is called nominee. All money left in the FA entity will flow

back to the FA personal tax return via a schedule C or K-1 depending on

the type of entity.

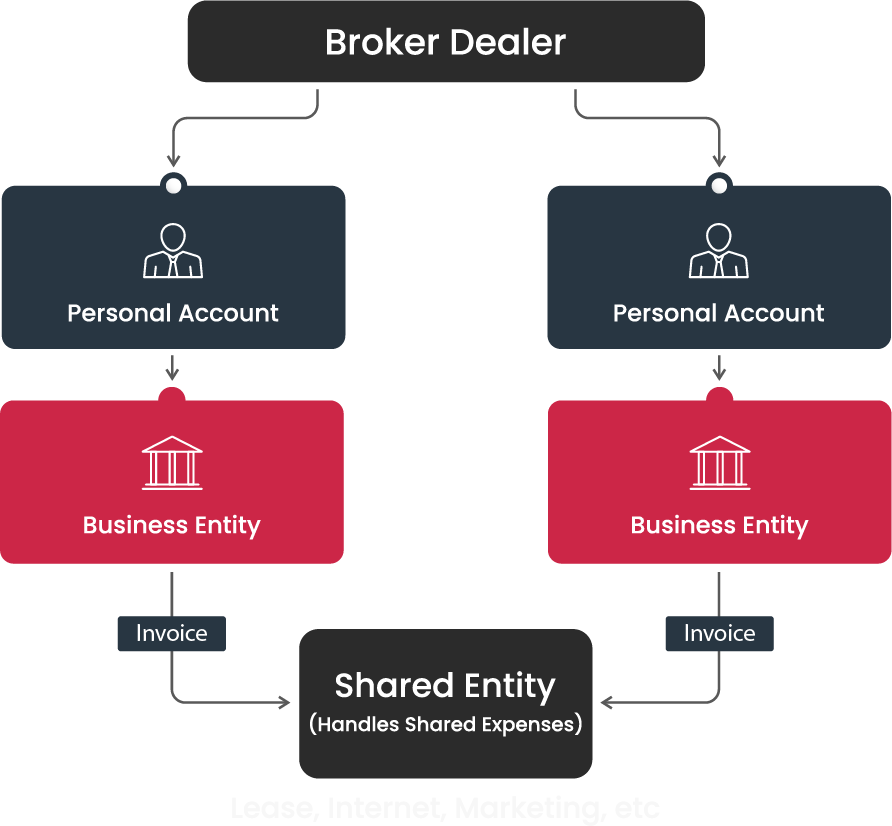

MULTI-OWNER FA

Each Advisor is paid on the 10th of the month based on any account that

has your rep code attached to it.

Each FA needs to set up a new personal bank account because they are

paid via your social security number.

Each FA will set up their own individual Entity.

All FA involved in the Practice will set up a joint shared/Marketing

Entity.

Once the funds are received in your personal account, they will transfer

100% into their individual Entity account.

All Bills -Contracts will (example lease and Internet) be set up under

the joint entity.

Each FA will be responsible for their proposition share for the invoice.

The joint entity will invoice each FA for their share of the bill and

then the joint entity will pay the invoices.

All business expenses will be paid at the entity level, including

Salary, distribution, and other expenses. You will need a comprehensive

operating agreement to outline expenses, contract, and distribution

level approvals.

The main difference in this scenario is you will have FA that are not

part of the shared Entity – owner in the Primary Practice.

Typically,

they still need to set up their own entity unless you add them as an

employee. If they are not an employee, they are a1009 worker and you

will have some type of shared expense agreement with them based on

the

services and tools you will be supporting. This can be paid out as a

split of the commissions, a flat fee or both. Each agreement can be

negotiated separately, and Myriad can assist you.

At the end of the year, each FA will receive 1099 from your Broker

Dealer for the amount deposited into your personal account. Each FA will

then create a 1099 from themselves to the Entity for the same dollar

amount this is called nominee. All money left in the FA entity will flow

back to the FA personal tax return via a schedule C or K-1 depending on

the type of entity.